Mandatory Director Identification Numbers (DIN)

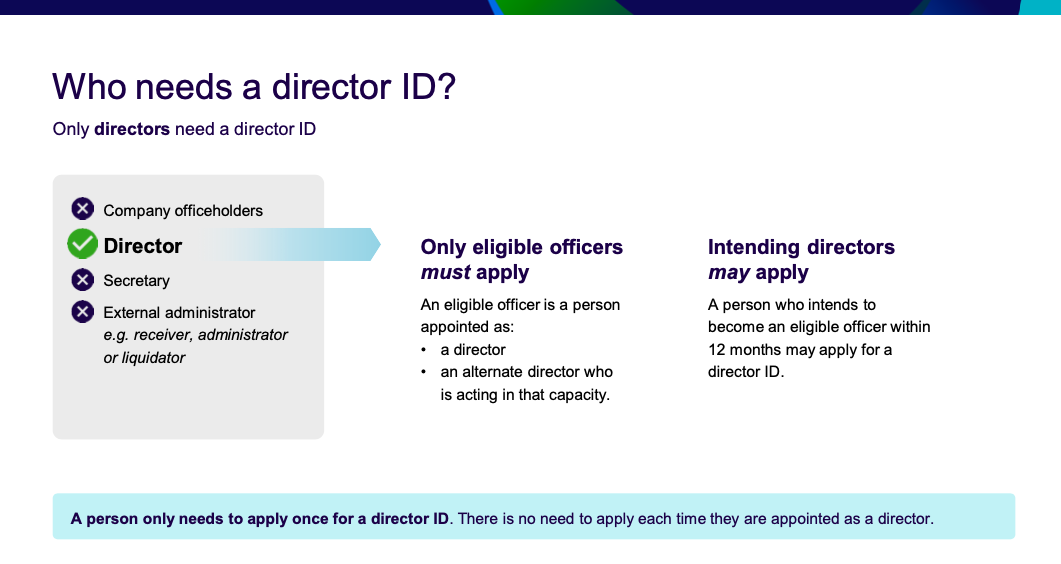

With the implementation of the Director Identification Numbers (DIN’s or Director ID’s) pending, it will be important to understand the new obligations for those operating in the capacity of a Director, as failure to apply for a DIN within the required time frame will leave you open to both criminal and civil penalties. It is one of the first initiatives under the Modernising of Business Registers Program and will be a legal requirement. A person only needs to apply once for a Director ID, there is no need to apply each time you are appointed a Director.

What Does it Mean to have a Director ID?

The Director ID will be a unique identifier that a Director will keep forever, enabling regulators to better track of Directors of failed companies who use fabricated identities. It will help identify business who are doing the wrong thing. The new system will help overcome issues with data integrity, which have always been a constant battle in regulating phoenixing and the illegal activities around this dilemma. This compliance regulator will further support small businesses by keeping out the operators that are breaking the law.

What is Phoenixing

Phoenixing is when companies deliberately avoid paying liabilities by shutting down an indebted company and transferring assets to another company. This hurts trade creditors, employees, and the public through lost taxes. The main aim of the Modernising of Business Registers Program is to protect legitimate businesses. To stop directors who are leaving unpaid creditors behind. By identifying those questionable directors from deliberately avoiding their obligations, government departments can be there to support credible businesses. Putting identification on the front end of business means we know who we are dealing with when it comes to trading with a business. There is a legislative provision to deactivate the Director ID if needed.

When does the Application Process Start?

- New Directors / New Entities

- Doesn’t apply yet, unless you are invited.

- From 1st November 2021: Must apply within 28 days.

- From 5th April 2022: must apply before being appointed.

- Existing Directors / Existing Entities

- Doesn’t apply yet, unless you are invited.

- But must obtain prior to 30th November 2022. (transition period)

- Future Directors:

- A person who intends to be appointed, may apply up to 12 months before.

- Corporations (Aboriginal and Torres Strait Islander Act 2006 CASTSI Act)have an extra 12 months. Must apply by 30th November 2023.

- NFP Sector – working through this at the moment. Information to follow.

- What it Means to be a Director of a CompanyDirectors are bound by certain rules that govern behaviour. They must carry out the duties as a director in good faith, in the interests of the company (even if that conflicts with personal interest), and for a proper (legal) purpose. Company Officers – Director & SecretaryOfficeholders of a company must be registered with ASIC and their details kept up to date. A proprietary limited company must have at least one director and one member but does not need to have a secretary. A public company must have at least three directors, one secretary and one member. If the officeholders are appointed or changed, or any of their personal contact details change, ASIC must be notified. Any changes to company details must be made online. Eligibility to be an Officeholder

- Must be at least 18 years of age and consent to taking on the role and responsibilities.

- Must not be an undischarged bankrupt.

- Must not be subject to a personal insolvency agreement under Part X of the Bankruptcy Act 1966and the terms of agreement not fully complied with.

- Must not be subject to a composition under Part X of Bankruptcy Act 1966 where final payment has not yet been made.

- Must not have been convicted of offences such as fraud, breach of director duties, or insolvent trading within the last 5 years. If conviction has resulted in imprisonment, a role may not be accepted within 5 years of release from prison.If a director, while holding office, becomes bankrupt, does not fully comply with a personal insolvency agreement, or is convicted of an offence, that officeholder automatically is disqualified from managing corporations and must cease to be a director of a company unless they have been given leave by the court to manage corporations. The company must notify ASIC immediately. Directors’ Responsibilities and Obligations

- To act in good faith in the best interests of the company and for a proper purpose.

- To exercise care and diligence.

- To avoid conflicts between the interests of the company and your personal interests.

- To prevent the company trading while insolvent (i.e. while it is unable to pay its debts as and when they fall due).

- If the company is being wound up ad director must report to the liquidator on the affairs of the company and help the liquidator.

- Keep adequate financial records.

- Lodge annual statements with ASIC.It is expected that a director can guide and monitor the management of their company. A director’s responsibilities are not changed or limited by previous experience (or lack thereof). Directors have a duty to act with honesty and diligence according to the legal obligations as set out in the Corporations Act 2011, and any other relevant laws such as Superannuation Guarantee Act 2009 and Goods and Services Tax Act 1999. Directors’ Duties

- To act honestly.

- Not to improperly use inside information or position as director.

- To avoid a conflict of interest and to disclose material personal interest at a directors’ meeting (where there are multiple directors for the company).

- Not to engage in insolvent trading.

- To take care and act diligently.

- Not to abuse a corporate opportunity.

- To act in the best interests of the company, even if this is conflict with personal interests.NFP Board of ManagementA NFP board of management is responsible for acting on behalf of and reporting to the NFP organisation’s members and/or shareholders. There may be an executive committee (the board of management) as well as other committees for general and/or special purposes. The board must oversee overall business performance, ensuring the entity is fulfilling the objectives as set out in the constitution and also supporting the managers of the business. The board must also supervise overall compliance performance – not only with the Corporations Act 2001, but also with regard to all relevant legal obligations – for example, registrations, licenses, insurances, PAYG withholding, superannuation guarantee (SG), workers compensation, privacy laws and record keeping. Liability can extend to individual office holders, committee members or directors depending on the structure of the organisation. An incorporated association must indemnify its office holders with appropriate insurance. It may also be appropriate for some board members to have directors’ insurance. Directors’ Responsibilities Regarding InsolvencyA director cannot knowingly allow a company to trade whilst insolvent. If the company is experiencing continual losses, poor cashflow, unpaid creditors, high debt to the ATO and unpaid SG then consideration to declare insolvency must be given before incurring any more debt. Director Penalty RegimeThe director penalty regime ensures that the company meets its payroll compliance obligations by making the directors personally liable for unpaid SG and PAYG withholding tax liabilities. This is governed by the ATO, which sends out penalty notices to directors where a company has failed to pay SG and PAYGW on time. New directors can become liable for unpaid payroll liabilities of the company which were due prior to their date of appointment. It is important that new directors make enquiries prior to their appointment to ascertain if there are any unpaid and unreported PAYGW or SGC amounts.